How Personal Loans Canada can Save You Time, Stress, and Money.

How Personal Loans Canada can Save You Time, Stress, and Money.

Blog Article

What Does Personal Loans Canada Mean?

Table of ContentsPersonal Loans Canada for BeginnersThe Facts About Personal Loans Canada Revealed5 Easy Facts About Personal Loans Canada ExplainedNot known Details About Personal Loans Canada Personal Loans Canada - An Overview

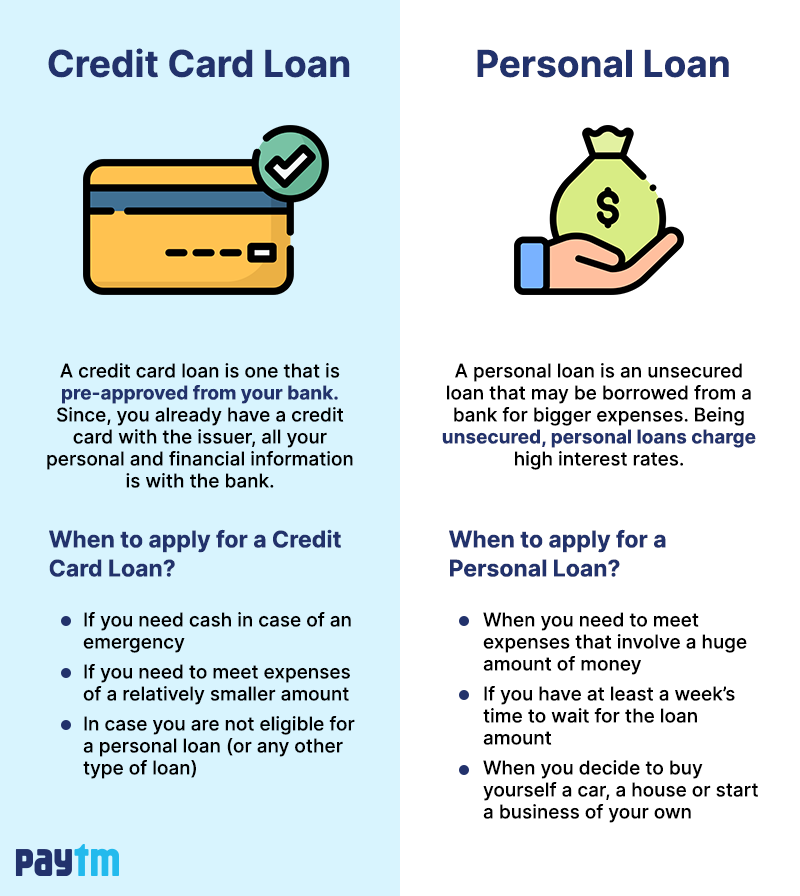

Settlement terms at the majority of individual lending lenders vary in between one and seven years. You get every one of the funds at the same time and can use them for almost any kind of function. Consumers typically utilize them to fund a property, such as a car or a boat, repay financial debt or assistance cover the cost of a significant cost, like a wedding event or a home renovation.

A set rate provides you the security of a foreseeable monthly repayment, making it a popular option for consolidating variable price credit scores cards. Settlement timelines vary for individual fundings, yet customers are usually able to pick repayment terms between one and seven years.

Indicators on Personal Loans Canada You Need To Know

You may pay a preliminary source cost of approximately 10 percent for a personal funding. The cost is generally deducted from your funds when you finalize your application, minimizing the quantity of cash money you pocket. Individual car loans rates are a lot more straight connected to short-term rates like the prime rate.

You might be supplied a reduced APR for a shorter term, since lending institutions understand your equilibrium will certainly be repaid faster. They may charge a higher price for longer terms knowing the longer you have a car loan, the most likely something can transform in your finances that can make the repayment unaffordable.

An individual funding is likewise a great alternative to making use of bank card, since you borrow cash at a fixed rate with a guaranteed benefit date based upon the term you pick. Bear in mind: When the honeymoon is over, the regular monthly repayments will be a pointer of the money you invested.

About Personal Loans Canada

Before handling financial obligation, utilize a personal loan settlement calculator to aid budget. Gathering quotes from multiple lenders can aid you identify the very best offer and possibly save you passion. Compare rates of interest, costs and lending institution reputation prior to requesting the financing. Your credit rating is a big variable in determining your eligibility for the lending in addition to the interest see here price.

Before applying, know what your rating is to ensure that you recognize what to expect in regards to expenses. Watch for covert fees and charges by reading the lending institution's terms and conditions web page so you don't end up with less cash than you need for your financial goals.

Personal finances require proof you have the credit score account and income to settle them. They're simpler to certify for than home equity lendings or various other guaranteed loans, you still need to show the lender you have the methods to pay the loan back. Individual lendings are better than bank card if you want an established month-to-month settlement and need every one of your funds at the same time.

Personal Loans Canada for Dummies

Credit report cards might likewise use benefits or cash-back choices that personal loans don't.

Some lenders might additionally charge costs for individual finances. Personal car loans are car loans that Visit This Link can cover a number of individual costs. You can discover individual financings via banks, cooperative credit union, and online loan providers. Personal loans can be safeguarded, implying you require collateral to borrow cash, or unprotected, without any security required.

, there's usually a set end day by which the funding will certainly be paid off. A personal line of credit report, on the various other hand, might remain open and offered to you forever as lengthy as your account continues to be in good standing with your lender.

The cash obtained on the car loan is not strained. If the lending institution forgives the lending, it is thought about a canceled financial debt, and that quantity can be exhausted. A safeguarded individual funding needs some kind of collateral as a condition of loaning.

Getting My Personal Loans Canada To Work

An unprotected individual loan requires no collateral to borrow money. Banks, credit rating unions, and online loan providers can provide both protected and unprotected individual financings to certified borrowers.

Again, this can be a bank, cooperative credit union, or click over here on-line personal car loan lender. Usually, you would certainly initially complete an application. The loan provider evaluates it and makes a decision whether to authorize or reject it. If approved, you'll be given the car loan terms, which you can accept or reject. If you consent to them, the next step is finalizing your lending paperwork.

Report this page